iowa homestead tax credit calculator

The current credit is equal to the actual tax levy on the first 4850 of actual value. What is a Homestead Tax Credit.

Tax Rules For Canadians Abroad Prasad Knowledge Base

To be eligible a homeowner must occupy the.

. Review real professional profiles see prior experience and compare prices in one place. The homestead credit is a tax credit funded by the state of iowa for qualifying homeowners and is based on the first 4850 of net taxable value. Iowa City Assessor.

913 S Dubuque St. Ad They did an excellent job. New applications must be made with the Assessor on or before July 1 of the year the exemption is first claimed.

How much is the homestead tax credit in Iowa. Start Your Tax Return Today. Must own and occupy the property as a homestead on July 1 of each year declare residency.

Property owners must sign with the City or County Assessor and qualify under standards set by the State of Iowa. Scroll down to the Homestead Tax Credit section and click on the link that states. In 2021 the Iowa legislature passed SF 619.

Discover Helpful Information And Resources On Taxes From AARP. Max refund is guaranteed and 100 accurate. Homeowners may qualify and sign for a Homestead Exemption with the city or county assessor.

You can apply for the Iowa Homestead Tax Credit by filling out Homestead Tax Credit Application 54-028. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. Free means free and IRS e-file is included.

Ad All Major Tax Situations Are Supported for Free. Change or Cancel a Permit. Apply online for the Iowa Homestead Tax.

As with the Homestead Tax Credit the exemption remains in effect until the. Equals 100 Actual Value multiplied by the. How do I estimate the net tax for a residential property with Homestead and Military Tax Credit.

Register for a Permit. Division 28 of that bill expanded eligibility for the property tax credit under Iowa Code chapter 425 subchapter II based on. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Application for Homestead Tax. I hired them again and they did a great job with that too. This rule making defines under honorable conditions for purposes of the disabled veteran tax credit and the military service tax exemption describes the application requirements for the.

For most taxpayers the Homestead Credit equals 4850 divided by 1000. In the state of Iowa homestead credit is generally based on the first 4850 of the homes Net Taxable value and to qualify for the credit homeowners must. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value.

52240 The Homestead Credit is available to all homeowners who own and occupy the. Confirm that the ownership record is correct you should be listed. For additional information and for a copy of the application please.

The Military Tax Credit is an exemption intended to. New applications must be made with the Assessor on or before July 1 of the year the exemption is first claimed. Track or File Rent Reimbursement.

The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first. As with the Homestead Tax Credit the exemption remains in effect until the.

Calculating Taxes When Day Trading In Canada Fbc

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax

Rent Vs Buy Calculator Is It Better To Rent Or Buy Smartasset Com Retirement Calculator Financial Advisors Property Tax

A Guide To Cryptocurrency And Nft Taxes

Is Life Insurance Taxable Forbes Advisor

Claiming Carrying Charges And Interest Expenses 2022 Turbotax Canada Tips

/Debtratio-final-467aac5bb30d46d8b9cd4f052fb2e858.png)

Debt Ratio Meaning Formula And Example

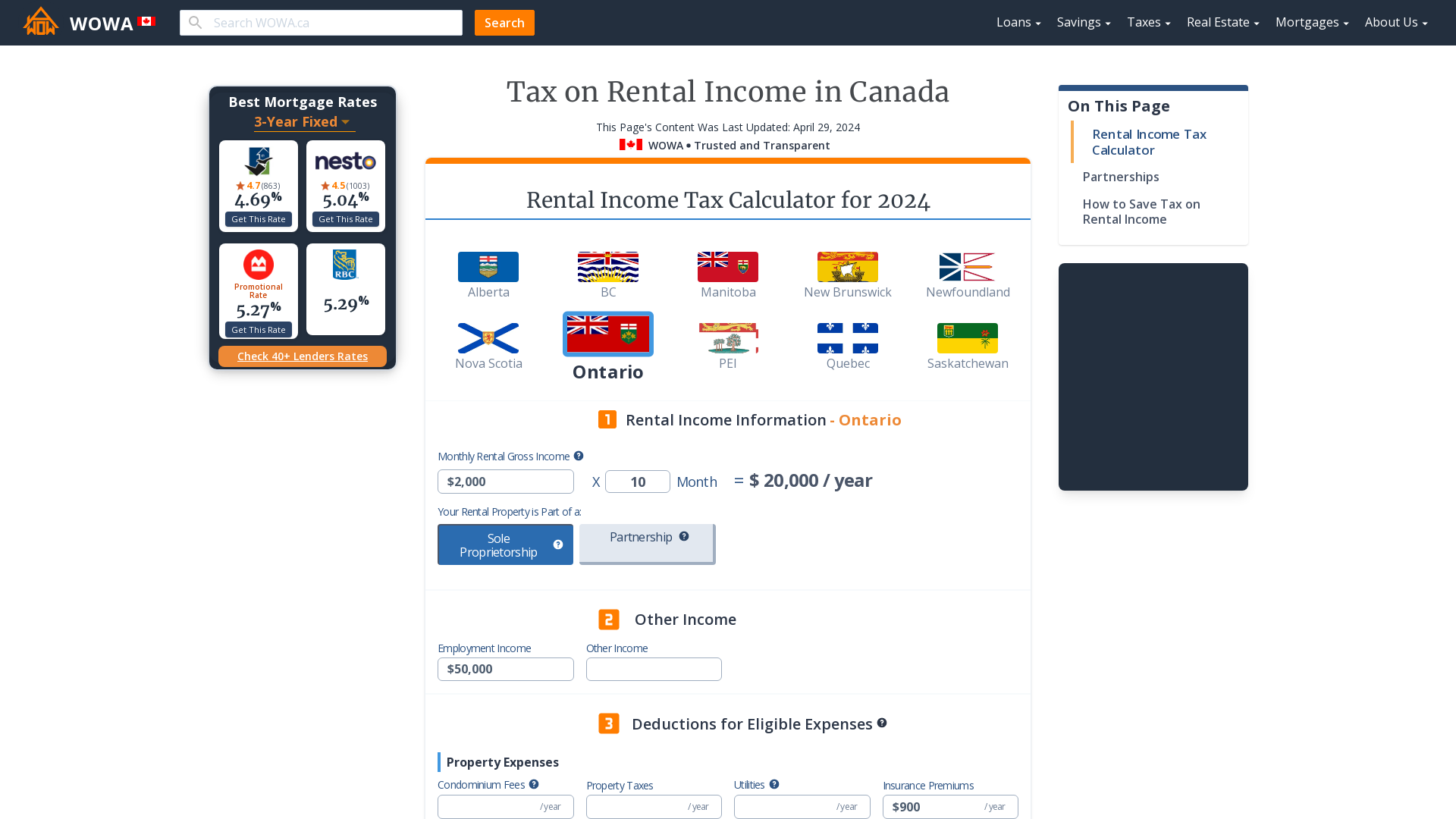

Tax On Rental Income Calculator Tips Wowa Ca

Us Citizens Living Abroad Do You Have To Pay Taxes

Dr Matt Motil On Twitter Real Estate Slogans Real Estate Ads Real Estate Quotes

Germany Tax System For Expats How To Pay Taxes In Germany

The Tax Consequences Of Leaving Canada Permanently

A Guide To Cryptocurrency And Nft Taxes

2022 Capital Gains Tax Rates By State Smartasset

Buying A Second Home Tax Tips For Homeowners Turbotax Tax Tips Videos