foreign gift tax cpa

Receive over 16388 from foreign corporations or. The gift tax rates start at 18 and increase to a maximum rate of 40.

Who Pays Taxes On A Gift Gift Tax Exemption The American College Of Trust And Estate Counsel

Citizen and you received 100000 or more from a nonresident alien individual or foreign estate.

. CPA Ted Kleinman has over three decades of experience and knowledge in dealing with IRS tax regulations and he will ensure that your tax needs are addressed. Specifically the receipt of a foreign gift of over 100000 triggers a requirement to file a Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign. Klasing online or call 800 681-1295 today.

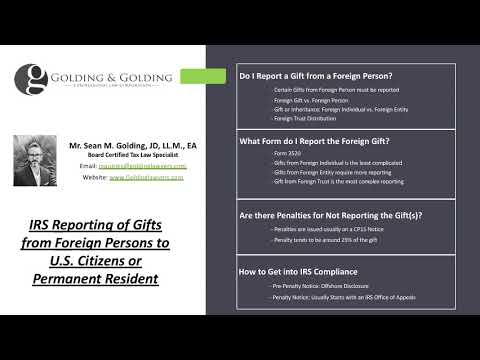

The tax applies. If the gift is from a nonresident alien or a foreign estate reporting is only required if the total amount of gifts from the nonresident alien or foreign estate is more than 100000. International Tax Gap Series.

Foreign Gift Reporting. Greater of 10000 or 35 of the gift received additional penalties may also be imposed if failure to file is not corrected. While you may not have to.

Penalty for non-compliance. In general the due date. Person then the donee.

Although reporting is only. For example if a foreign corporation receives a gift from another foreign corporation but the donee corporate entity is owned by a US. Consulting and Scalable Services to Help Businesses with Foreign and International Taxes.

Person other than an organization described in section 501c and exempt from tax under section 501a of the Internal Revenue Code who. To arrange a reduced-rate consultation contact the Tax Law Office of David W. Receive over 100000 of gift or bequest from foreign individuals or estate.

Gift tax would be due on gifts exceeding the 15000 exclusion amount. If the gift was given as an inheritance then the estate of the decedent must pay it. The individual that offered the gift would be responsible for paying the gift tax.

File Form 3520 each year you receive a foreign gift separately from your income tax return by following the directions in the Instructions to Form 3520. If you are a US. There are significant penalties for failure to timely file Form 3520.

Foreign Trust and Foreign Gift. Get us on New York New Jersey let us help. CPA First has experienced international tax accountants quality tax lawyers who provide all kinds of international accounting tax services.

Foreign gift tax cpa Tuesday May 17 2022 Edit. Reporting is required if aggregate foreign gifts from a nonresident alien or individual estate and from foreign partnerships or corporations exceeds a. SCHEDULE A REDUCED RATE INITIAL CONSULTATION.

Regarding the latter as of 2019 you will need to file Form 3520 if youre a US. To make an appointment. Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than.

If you own a foreign trust and you are a US person you need to file Form 3520-A annually. Klasing online or call 800 681-1295 today. However if the gift is from a foreign corporation or foreign partnership the threshold is much lower 14375 for gifts made during a tax year beginning in 2011.

Form 3520 and 3520-A. In the following situations you need to file a Form 3520 with the IRS. Foreign gift is not.

Form 3520 is an informational return and not a tax return because foreign gifts are not subject to income tax.

Reporting Foreign Gifts And Transfers To The Irs As Yacht Crew

Kirkland Wa Cpa Firm International Tax Services Page Mary H Hawkins Cpa Ps

Amazon Foreign Sellers U S Taxation And 1099 K Reporting O G Tax And Accounting

Fa La La Falling Afoul Of Foreign Gift Rules Ryan Wetmore P C

International Tax Preparation Bay Area Cpas Consultants

What Expats Need To Know About Foreign Inheritance Tax

Foreign Gift Reporting Requirements Henry Horne

Do I Have To Pay Taxes On A Gift H R Block

Andersen Independent Tax Valuation Financial Advisory And Consulting Services For Individual And Commercial Clients Andersen

Foreigners Filing Us Tax International Tax Cpa Expat Tax Global Business Firpta Phoenix Us

Foreign Gift Tax Ultimate Insider Info You Need To Know For 2022

Irs Reporting Requirements For Gifts From A Foreign Person

Klr What Are The Rules For Receiving Gifts From A Foreign Person

Us Gift Estate Taxes 2022 Gifts Transfer Taxes Htj Tax

![]()

2022 International Tax Update Individual And Estate Tax Western Cpe

Gifts From Foreign Person How U S Citizens Residents Report A Foreign Gift To Irs On Form 3520 Youtube

Part I New Form 8858 Filing Requirement For Foreign Realty Rentals And Business Income With Tax Credit Penalty Abitos Cpas And Advisors

19 Possible Questions That Your International Tax Preparer Ought To Ask

2022 International Tax Update Individual And Estate Tax Western Cpe