jersey city property tax calculator

Likewise the median annual property tax. Valencia County is located south of Albuquerque and has relatively low property tax rates compared to other counties the greater Albuquerque area.

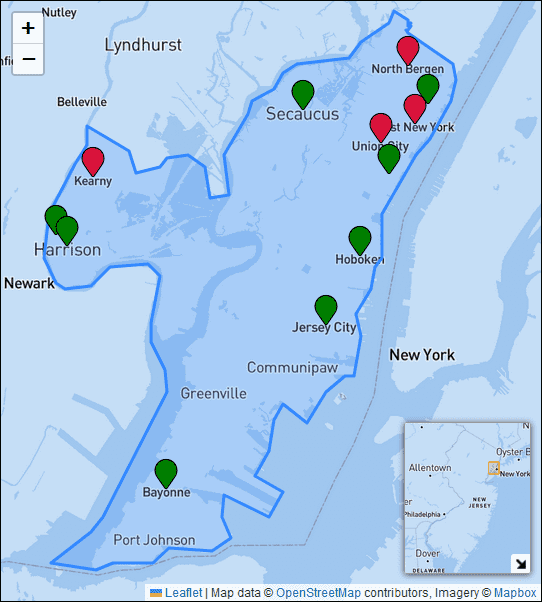

Nyc Property Taxes Compared To New Jersey

Only households with a total gross income of less than 60000 are eligible for this credit.

. That is also well over double the national average. Compared to the 107 national average that rate is quite low. Tax amount varies by county.

The countys average effective property tax rate is 346. Part of the reason taxes are so low is that owner-occupied residences get the benefit of a lower assessment rate than commercial and second residences. The median annual property tax payment in the county is just 1768.

Dodge County is located in eastern Nebraska and is just northwest of Omaha the largest city in the state. Ad Valorem tax means the tax is based on the value of the transaction of the propertyIn NJ the value of the property is based. NJ Property TaxesNew Jersey real estate property tax is an ad valorem tax.

Suffolk County has one of the highest median property taxes in the United States and is ranked 12th of the 3143 counties in order of median property taxes. That was up by 104 year-over-year. That is the sixth-highest figure among Utah counties but is still more than 1000 less than the national median.

The states average effective property tax rate is just 053. Ohio Property Tax Rates. DEC 20 2020.

Property tax rates in Ohio are expressed as millage rates. The credit caps property taxes based on income level. The Whatcom County average effective property tax rate is 085 compared to the Washington State average of 093.

Start filing your tax return now. However the median annual property tax payment in Scotts Bluff County is quite high at 2054. City Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate.

The countys average effective property tax rate is just 064 which is a bit more than half the national average. TAX DAY IS APRIL 17th - There are 178 days left until. Maine residents seeking low property tax rates might want to consider Hancock County.

One mill is equal to 1 of tax for every 1000 in assessed value. The average effective property tax rate in the county is 131 far below the state average of 205. As an example a household with a gross income of 30000 will receive a credit for any property tax.

The New Jersey sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the NJ state tax. The median home value in Norfolk County is 452500 more than double the national average. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Florida property tax records tool to get more accurate estimates for an individual property.

That rate comes in above both national and state averages. Thus while property tax rates in the county are not especially high on a statewide basis property tax bills often are high. Timothy has helped provide CEOs and CFOs with deep-dive.

New Jerseys median income is 88343 per year so the median yearly property. If you have questions about how property taxes can affect your overall financial plans a financial advisor in Cherry Hill can help you out. The median property tax in New Jersey is 189 of a propertys assesed fair market value as property tax per year.

We have over 74000 city photos not found anywhere else graphs of the latest real estate prices and sales trends recent home sales a home value estimator hundreds of thousands of maps satellite photos demographic data race income ancestries education employment geographic data state profiles crime data registered sex offenders cost of. Whatcom County sits in the northeast corner of Washington State along the Canadian Border. Suffolk County collects on average 17 of a propertys assessed fair market value as property tax.

New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. City Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate. The countys average effective property tax rate of 100 is the lowest in the state and well below the state average of 130.

The median property tax in Suffolk County New York is 7192 per year for a home worth the median value of 424200. Timothy Li is a consultant accountant and finance manager with an MBA from USC and over 15 years of corporate finance experience. Zillow has 46 homes for sale in Jersey City NJ matching Low TaxesView listing photos review sales history and use our detailed real estate filters to find the perfect place.

If you want to move to New Hampshire but dont want to pay high property taxes Carroll County may be your best bet. Homeowners in Olmstead County where Rochester is located face an average effective property tax rate of 120. The median annual property tax paid by homeowners in Utah County is 1517.

The median property tax payment in the county is just 1433. Homeowners in Nevada are protected from steep increases in property tax bills by Nevadas property tax abatement law which limits annual increases in property tax bills to a maximum of 3 for homeowners. Because of the differences in assessed value described above millage rates in one county cannot be directly compared to another.

This northern New Jersey county has effective property tax rates that are more than double the national average. Rates vary by school district city and county. In many cases we can compute a more personalized property tax estimate based on your propertys actual assessment valuations.

The median annual property tax payment in Norfolk County is 5592. The countys average effective property tax. The average effective property tax rate in Valencia County is 079.

The median annual property tax paid by homeowners in Scott County is 3303 which ranks as one of the highest annual taxes in the state. Its largest city is Provo. The countys average effective property tax rate is 118 which comes in as the fourth-highest rate of any North Carolina county.

Utah Property Tax Calculator. This western North Carolina County has property tax rates well below the state average. Certain items in tourist-heavy Atlantic City and Cape May County are subject to additional local sales taxesSome counties in New Jersey are not.

The average effective property tax rate in South Carolina is just 055 with a median annual property tax payment of 980. It has property tax rates well below the state average.

Property Tax Rates Average Tax Bills And Average Home Valuations In Hudson County New Jersey

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

Local Income Taxes In 2019 Local Income Tax City County Level

Jersey Village City Council Approves 17m Budget Tax Rate Increase For 2021 22 Community Impact

How Do State And Local Property Taxes Work Tax Policy Center

How Property Taxes Are Calculated

Property Tax Calculator Smartasset

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

New Jersey 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Property Taxes City Of Jersey City

How High Are Property Taxes In Your State Tax Foundation

Property Taxes Urban Institute

Property Tax Rates Average Tax Bills And Average Home Valuations In Hudson County New Jersey

Real Estate Transfer Tax Calculator New Jersey

Property Tax Calculator Smartasset

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara